Every day I try to become a better man, a better father, a better friend. Some days are good. Some days are a struggle. But, I work hard to form habits and establish systems to help drive my career, relationships, knowledge, skills, health, and life to the next level.

Today Ryan Michler over at Order of Man posted 5 daily habits to live by over on Instagram:

- Get physically strong

- Get physically strong

- Develop mental fortitude

- Acquire massive wealth

- Build your network

- Hone new skills

What I like about this list is it is clear, precise, and easy to remember. In addition, it is something that you can incorporate into your daily routine.

Getting Physically Strong

What are you doing every day to get physically strong? How are you preparing to protect yourself and your family if the SHTF? Doing what you can to become more physically healthy is critical to everything you are trying to accomplish.

Not only does exercise improve your physical health and ability to protect yourself and your family it also:

- Increase your energy level to do the things you want to do and reduce overall fatigue.

- Manage and prevent some diseases like arthritis, heart disease, stroke, and type 2 diabetes.

- It helps you sleep better.

- Exercise reduces levels of stress and anxiety.

- Reach and maintain healthy body weight and control weight gain.

- Improve your overall mood.

- Maybe improve cognitive function. Extremely important to all the other items on the list.

- Control your blood pressure.

The list of benefits is long, and the investment of time is small. However, as with any exercise routine, it may be advisable to consult a professional trainer or your doctor before starting any new training routine (habit).

If you are new to exercise, a great way to start is to close your exercise rings on your Apple Watch or maintain 10,000 steps each day. Then, see how many days in a row you can complete.

Another great thing that you can improve your skills is combining excise with a good eBook or eLearning course. No better feeling than completing your exercise routine for the day and learning something new!

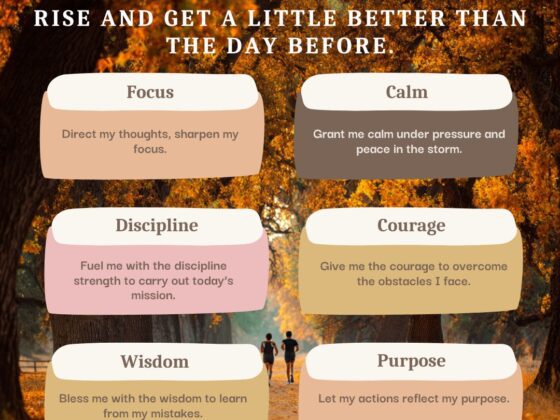

Develop Mental Fortitude

The mental toughness or high level of discipline while facing temptation, hardships, and life’s challenges to get work done defines mental fortitude. It is also key to helping you succeed in all your goals and processes to lead to something better and more fulfilling in your life. What separates the semi-talented athlete that creates a successful major league career and one with above-average talent that struggles with a minor league career? Talent does not mean anything if mental toughness is not present.

Mental fortitude is the x-factor that separates the dreamer from someone who achieves. Mental fortitude is not something everyone has. I am not sure if it is something you are born with, but I believe it can develop.

So how do you succeed in your plans, goals, or daily systems when life jumps in the way and throws you a curveball? Also, how do you persist when things do not go as planned?

I think Calvin Coolidge, our 30th President, may have said it best in the following quote:

Nothing in the world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan ‘Press On’ has solved and always will solve the problems of the human race.

Calvin Coolidge

I think President Coolidge is hitting on a key point about mental fortitude. Talent alone will not consistently achieve your goals. Mental fortitude is the secret ingredient that allows you to remain persistent and determined to achieve your goals and maintain your daily systems.

Discipline builds mental fortitude. People that have mental discipline have self-control. They can continuously complete the plans and systems even when faced with boredom, exhaustion, and other distractions. They push through and stick to their schedule and continue to execute.

Mental fortitude means completing the workout you have planned even if you are tired and tight work schedule. It means pausing for a moment when you are about to make that impulse buy at the store and instead build your wealth by investing.

Here are a couple of books that might help you with your mental fortitude.

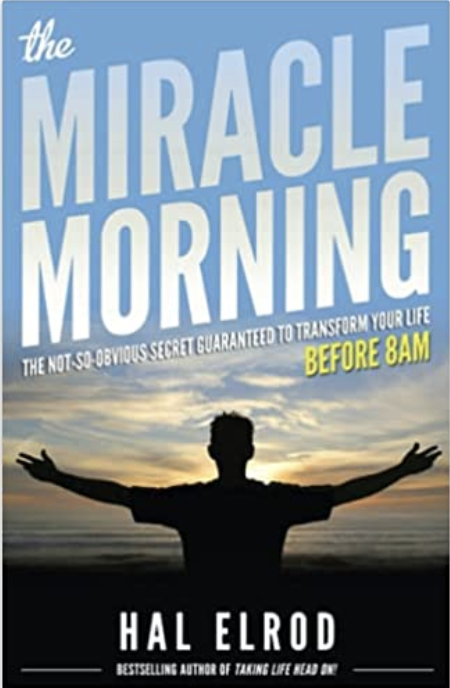

The Miracle Morning by Hal Elrod. This book will walk you through a series of best practices to start your morning off with a purpose. Next, it will give you some ideas on creating a foundation for focus and discipline for the rest of the day. Finally, it will help you build a routine for your mind and your body, which is critical to supporting your mind.

My next recommended book is Mindset: The New Psychology of Success by Carol S. Dweck. This book does a little more about teaching you to change your mindset. You will learn about what it means to have a mind “stuck in its ways” versus one that has shifted into a place of growth. Your mind is going to resist you trying to establish your mental fortitude. Dweck explains in this book how your beliefs can create boundaries to your abilities and what you think is possible. It would be best if you believed that change is possible because it is critical to your motivation and continued growth.

Another book I recommend is The Power of Discipline: How to User Self Control and Mental Toughness to Achieve Your Goals by Daniel Walter. That is a very long title but a very engaging and informative book. Daniel talks about how you need a solid foundation of self-discipline before you can achieve anything in life. Talent, intelligence, and skill are only a part of the equation. Positive thinking, affirmations, and vision boards are only a part of the equation. If you want to turn your dreams into reality, you need self-discipline.

The author also touches on something I believe that we are not born with self-discipline. It is something that we learn, like playing baseball or a second language. This book gives some explanations about the following topics:

- How to master self-discipline by targeting specific areas of the brain

- The Navy SEALs’ secrets to self-discipline

- The Zen Buddhists’ secrets to self-discipline

- How to make hard work exciting

- How to ditch your bad habits and adopt the practices of successful people

- Strategies to keep going when your motivation runs out

- And much, much more

The next book on my list is 13 Things Mentally Strong People Don’t Do by Amy Morin.

I like the basic premise of this book of focusing on thins Mentally Strong People do not do versus what they do. The hardest part about change is getting rid of the old habits, and this book gives you some critical insight into the right path. Amy Morin does not just give you half of the story. She also discusses the opposite of what not to do and what works to create a mentally strong person. She focuses on things she describes, “taking back your power, facing your fears, embracing change, and training your brain for happiness and success.”

Please give them a read and let me know what you think.

Acquire Massive Wealth

Okay this is one I struggle with. I struggle for two reasons. The first is I always convince myself that I just need enough to have a comfortable retirement. But this breaks the rule of aiming towards large goals that will help you grown and continue to challenge yourself. The second area is I am a bit of a impulsive buyer trying to push gratification into the present versus look at the long term road map and the rewards a care money management plan can bring you.

How the heck do you create a budget? Managing a budget is all about controlling impulse spending and making sure I have the assets I need to invest to cover the expenses for an unforeseen emergency. A quote from Robert Kiyosaki applies to my case and probably many others and directly relates to point number two of this post: developing mental fortitude.

How do you build this emotional discipline? The first part is making your budget and understanding your true wealth and cash flow. Set your goals, develop your systems to create enough passive income to cover your expenses.

The wealthy buy luxuries last, while the poor and middle class tend to buy luxuries first. Why? Emotional discipline.

Robert Kiyosaki

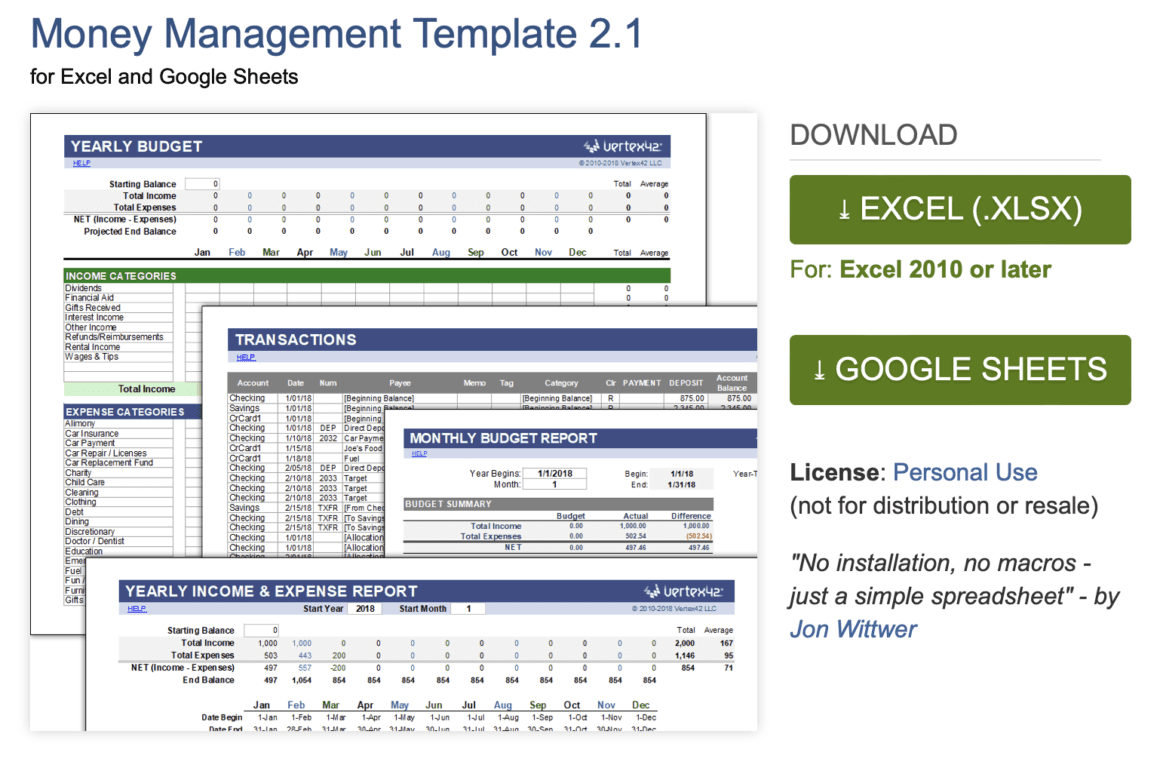

I love tools and templates when I do this kind of work, and one that I have found helpful is the Money Management Template from Vertex42. The template is a basic excel template that will help you summarize your budget, account balances, transactions, and various reports and goals.

So how do you build a basic budget? Consider these six simple steps:

Gather all your financial paperwork. You want to have all the detail you can have to create a monthly average of all your expenses. Records might include:

- Bank statements

- Investment accounts

- Recent utility bills

- W-2 and paystubs

- 1099s

- Credit card bills

- House and vehicle loans

- Receipts for the last six to eight months.

Summarize (Calculate) Your Income. Record your income as your salary after taxes. It could be child support or social security. It could include self-employed or passive income from investments. Using the recommended Money Management Template would record this information under income categories on the budget sheet.

Create a list of all your monthly expenses. You can record your monthly expenses under “Expense Categories” on the budget sheet in the Money Management Template. Expenses could include:

- House loan payments or rent

- Insurance

- Groceries

- Car payments

- School tuition and loans

- Utilities

- Entertainment

- Online services & subscriptions

- Cable and internet

- Phone & data plan charges

- Commuting costs

- Childcare

- Travel

- Entertainment

- Dining out (including your favorite coffee chain)

Determine Fix & Variable Expenses. Start to assess the spending in each of these categories of expenses. Start with your fixed costs and move on to your variable expenses.

What are fixed expenses? These are mandatory expenses, and you have to pay some fixed amount each month. These expenses include rent payments, car payments, internet service, child care.

Variable expenses will change from month to month, such as groceries, gasoline, coffee at your favorite shop, entertainment, and eating out.

Total all Your Monthly Income and Expenses. How did it turn out? If your income exceeds your expenses, you are off to a good start, and you can invest this money into retirement savings, investments, paying off debt.

The goal is to acquire massive wealth, or in other words, create some financial freedom for yourself and your family where your passive income from investments or other assets exceeds your expenses. What is passive income? Passive income is revenue generated in a way that doesn’t involve significant or ongoing labor, energy, or time to earn or maintain. In other words, it’s what’s referred to as “making money while you sleep.” Passive income comes from the dividends from your investment portfolio. For example, it could come from rental properties or land that has appreciated that you have sold and reinvested.

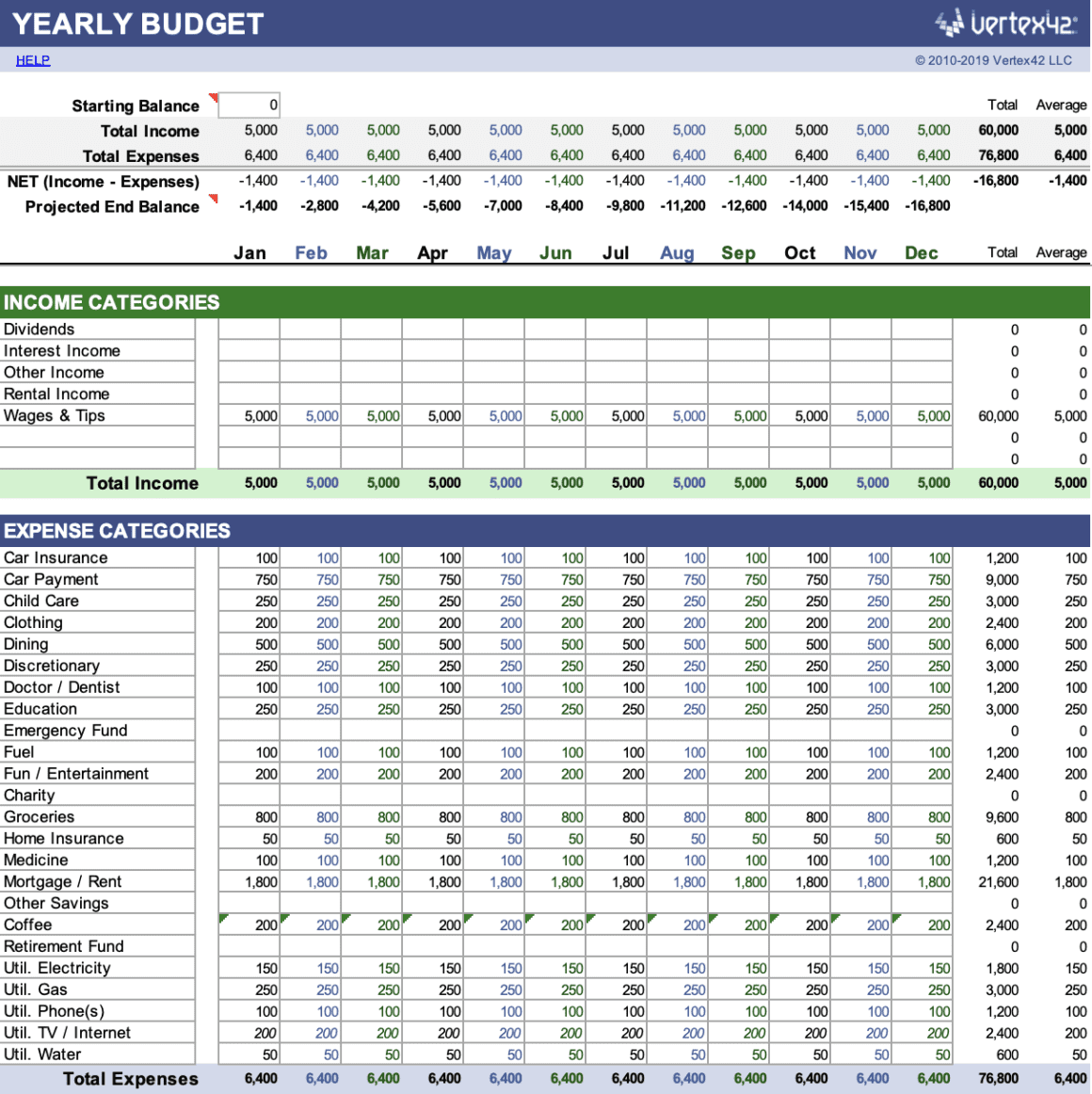

I have started with a $5000 monthly net income spread over 12 months in the sample below. The net income is your after-tax salary. The monthly expenses listed total $8400, leveraging credit cards each month to cover the gap. You can see that debt would quickly increase by $16,800 after one year.

In this situation you may want to adopt a “50-30-20” budgeting philosophy. In this kind of budget needs or essential items would represent half of your budget. Wants would make up 30% of you

In this situation, you may want to adopt a “50-30-20” budgeting philosophy. In this kind of budget, needs or essential items would represent half of your budget. Wants would make up 30% of your budget, and the final 20% would go towards savings.

Please refer to my post, Acquire Massive Wealth, with more details.

Make Adjustments to expenses. The benefit of having summarizing all your income and expenses is that you can do a deeper analysis to get your budget under control and build the foundation to create wealth and financial freedom.

If your income exceeds your expenses, look at ways to fine-tune and optimize your budget to save more and plan for your future. If your costs far exceed your income, like the example here, just reducing you, variable expenses may not be enough. You may have to take a look at your fixed costs like rent and car payments.