Okay this is one I struggle with. I struggle for two reasons. The first is I always convince myself that I just need enough to have a comfortable retirement. But this breaks the rule of aiming towards large goals that will help you grown and continue to challenge yourself. The second area is I am a bit of a impulsive buyer trying to push gratification into the present versus look at the long term road map and the rewards a care money management plan can bring you.

How the heck do you create a budget? Managing a budget is all about controlling impulse spending and making sure I have the assets I need to invest to cover the expenses for an unforeseen emergency. A quote from Robert Kiyosaki applies to my case and probably many others and directly relates to point number two of this post: developing mental fortitude.

How do you build this emotional discipline? The first part is making your budget and understanding your true wealth and cash flow. Set your goals, develop your systems to create enough passive income to cover your expenses.

The wealthy buy luxuries last, while the poor and middle class tend to buy luxuries first. Why? Emotional discipline.

Robert Kiyosaki

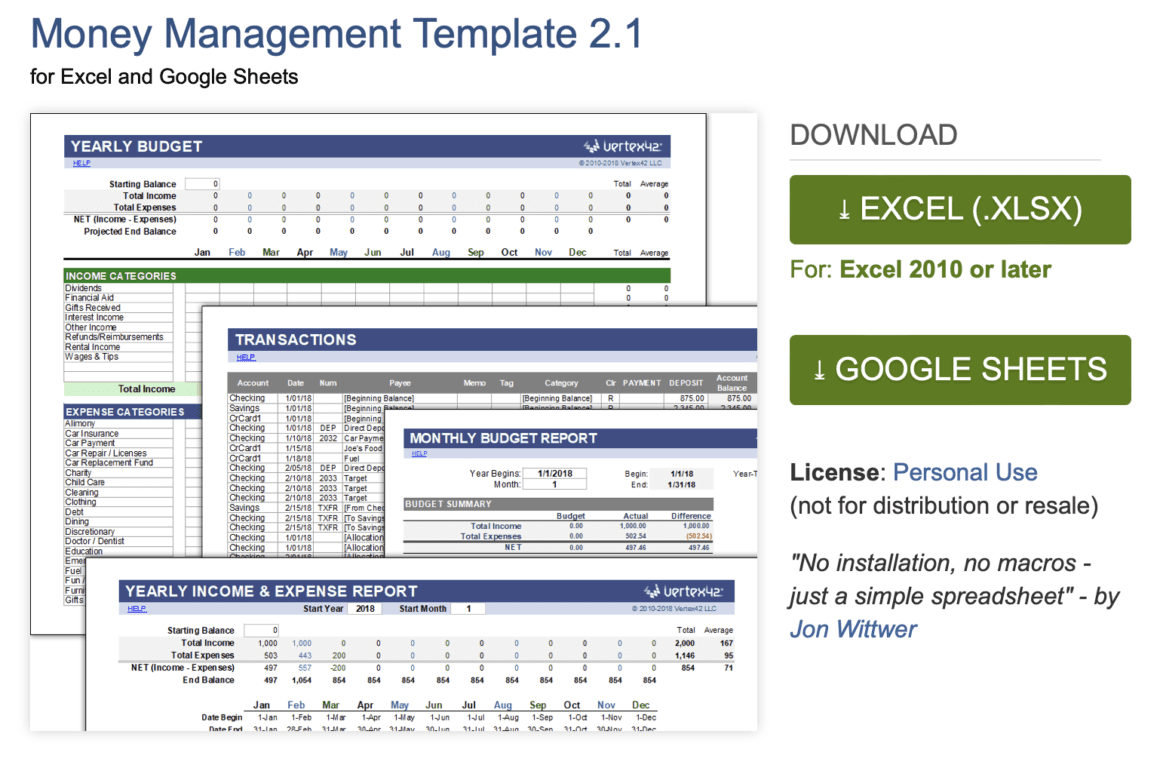

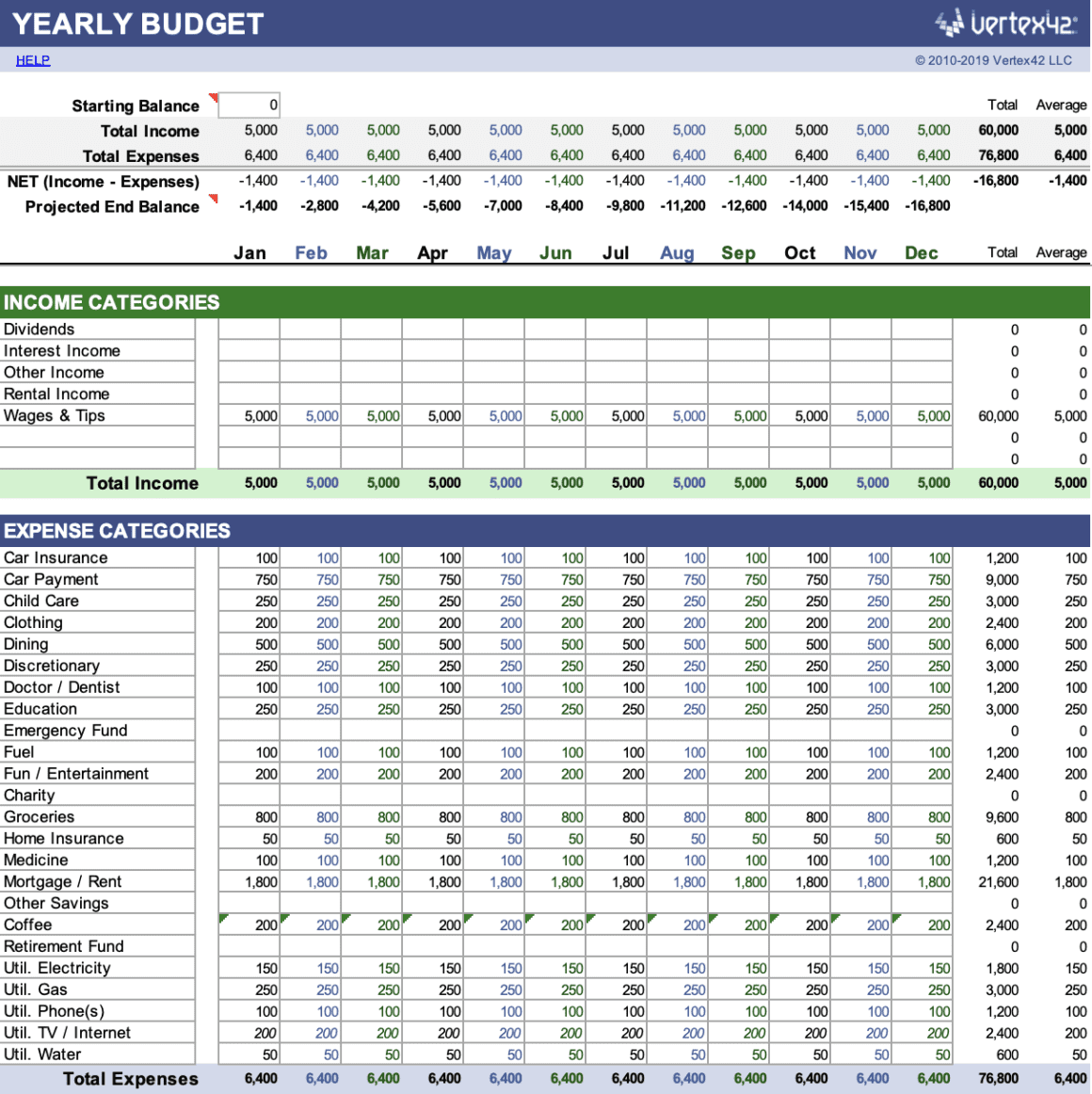

I love tools and templates when I do this kind of work, and one that I have found helpful is the Money Management Template from Vertex42. The template is a basic excel template that will help you summarize your budget, account balances, transactions, and various reports and goals.

So how do you build a basic budget? Consider these six simple steps:

Gather all your financial paperwork. You want to have all the detail you can have to create a monthly average of all your expenses. Records might include:

- Bank statements

- Investment accounts

- Recent utility bills

- W-2 and paystubs

- 1099s

- Credit card bills

- House and vehicle loans

- Receipts for the last six to eight months.

Summarize (Calculate) Your Income. Record your income as your salary after taxes. It could be child support or social security. It could include self-employed or passive income from investments. Using the recommended Money Management Template would record this information under income categories on the budget sheet.

Create a list of all your monthly expenses. You can record your monthly expenses under “Expense Categories” on the budget sheet in the Money Management Template. Expenses could include:

- House loan payments or rent

- Insurance

- Groceries

- Car payments

- School tuition and loans

- Utilities

- Entertainment

- Online services & subscriptions

- Cable and internet

- Phone & data plan charges

- Commuting costs

- Childcare

- Travel

- Entertainment

- Dining out (including your favorite coffee chain)

Determine Fix & Variable Expenses. Start to assess the spending in each of these categories of expenses. Start with your fixed costs and move on to your variable expenses.

What are fixed expenses? These are mandatory expenses, and you have to pay some fixed amount each month. These expenses include rent payments, car payments, internet service, child care.

Variable expenses will change from month to month, such as groceries, gasoline, coffee at your favorite shop, entertainment, and eating out.

Total all Your Monthly Income and Expenses. How did it turn out? If your income exceeds your expenses, you are off to a good start, and you can invest this money into retirement savings, investments, paying off debt.

The goal is to acquire massive wealth, or in other words, create some financial freedom for yourself and your family where your passive income from investments or other assets exceeds your expenses. What is passive income? Passive income is revenue generated in a way that doesn’t involve significant or ongoing labor, energy, or time to earn or maintain. In other words, it’s what’s referred to as “making money while you sleep.” Passive income comes from the dividends from your investment portfolio. For example, it could come from rental properties or land that has appreciated that you have sold and reinvested.

I have started with a $5000 monthly net income spread over 12 months in the sample below. The net income is your after-tax salary. The monthly expenses listed total $8400, leveraging credit cards each month to cover the gap. You can see that debt would quickly increase by $16,800 after one year.

In this situation you may want to adopt a “50-30-20” budgeting philosophy. In this kind of budget needs or essential items would represent half of your budget. Wants would make up 30% of you

In this situation, you may want to adopt a “50-30-20” budgeting philosophy. In this kind of budget, needs or essential items would represent half of your budget. Wants would make up 30% of your budget, and the final 20% would go towards savings.

Please refer to my post, Acquire Massive Wealth (need to add link), with more details.

Make Adjustments to expenses. The benefit of having summarizing all your income and expenses is that you can do a deeper analysis to get your budget under control and build the foundation to create wealth and financial freedom.

If your income exceeds your expenses, look at ways to fine-tune and optimize your budget to save more and plan for your future. If your costs far exceed your income, like the example here, just reducing you, variable expenses may not be enough. You may have to take a look at your fixed costs like rent and car payments.